Leveraging digital finance to increase resilience of ACP countries

Duration: 48 months (from December 2020)

EU Contribution: EUR 14.5 million

Location: Trinidad and Tobago, Eastern Caribbean States Africa, Gabon, Niger, Malawi and Ethiopia, Vanuatu, Samoa, Timor Leste, Tonga and Fiji

Implementing partner: United Nations Capital Development Fund (UNCDF)

Overview:

Today more than ever, digital technologies have a central role to increase access and usage of affordable financial products and services that meet people and business needs as well as accelerate economic recovery from the coronavirus pandemic. The access to digital finance and infrastructure is a major determinant of how resilient societies and businesses are in the face of the shocks caused by the pandemic.

The program will contribute to the deployment of digital finance solutions at the scale and speed necessary to deepen financial inclusion and accelerate economic recovery from COVID-19, to make economies and societies more resilient to external shocks.

The program will work with regulators, policy makers, regional bodies, financial services providers (including banks, MFIs, FinTechs, MNOs), MSMEs and people living in poverty in particular women and youth.

Expected Objectives and Results

Overall Objective: Contribute to poverty reduction through the deployment of digital finance solutions at the scale and speed necessary to deepen financial inclusion and accelerate economic recovery from COVID-19, to make economies and societies, more resilient to external shocks.

Specific Objective 1) Improve digital finance policies and regulations to provide early response to emergencies and create an enabling environment to social and economic recovery.

Specific Objective 2) Create and strengthen digital finance ecosystems that support low income individuals in particular women and youth; and MSMEs to mitigate immediate shocks of emergencies and seize economic opportunities.

The main results of the action are the following:

Result 1) Policies and regulations are adopted that enable wider access and usage of inclusive digital financial services.

Result 2) Digital financial services are developed and deployed by government and private sector providers, using payment services and digital solutions that are accessible, affordable, responsible, reliable, and appropriate.

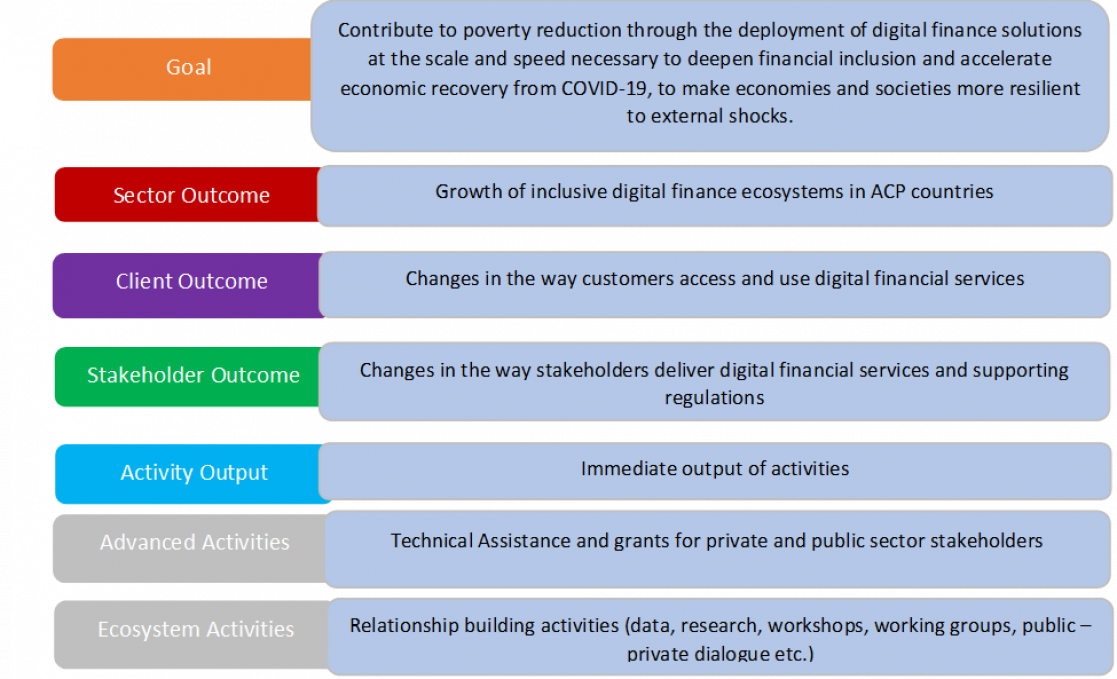

Theory of Change:

The goal of the action is to contribute to poverty reduction through the deployment of digital finance solutions at the scale and speed necessary to deepen financial inclusion and accelerate economic recovery from COVID-19, to make economies and societies, more resilient to external shocks.

The figure below represents the levels of the theory of change to achieve this goal.